“Embrace the enriching journey of volunteering abroad with safety and peace of mind. Discover how travel & health insurance, especially from platforms like VolunteerCard and A Broader View, protect you from uncertainties. Dive into FAQs to learn more.”

Traveling abroad for volunteer work is an admirable and enriching experience. Whether you are building schools in Africa, teaching English in Asia, or conserving wildlife in South America, you are making a difference in the world. However, with such an experience comes risks and uncertainties. This is where travel and health insurance, particularly through platforms like VolunteerCard and A Broader View, becomes a necessity.

Benefits of Travel and Health Insurance for Volunteers:

- Peace of Mind: Knowing you’re covered for any unexpected incidents allows you to focus on your volunteer work.

- Medical Emergencies: Access to quality healthcare without worrying about the costs if you fall ill or get injured.

- Trip Cancellation or Interruption: Reimbursement for pre-paid travel expenses if unforeseen circumstances arise.

- Lost or Stolen Belongings: Coverage for personal items that might get lost or stolen during your trip.

- Flight Delays or Missed Connections: Compensation for any added expenses due to flight issues.

- Evacuation: In extreme situations, you might require emergency evacuation. The right insurance will cover these costs.

- Repatriation of Remains: In the worst-case scenario, insurance will cover the cost to bring a person’s remains home.

- 24/7 Support: Immediate assistance and support, no matter where you are in the world.

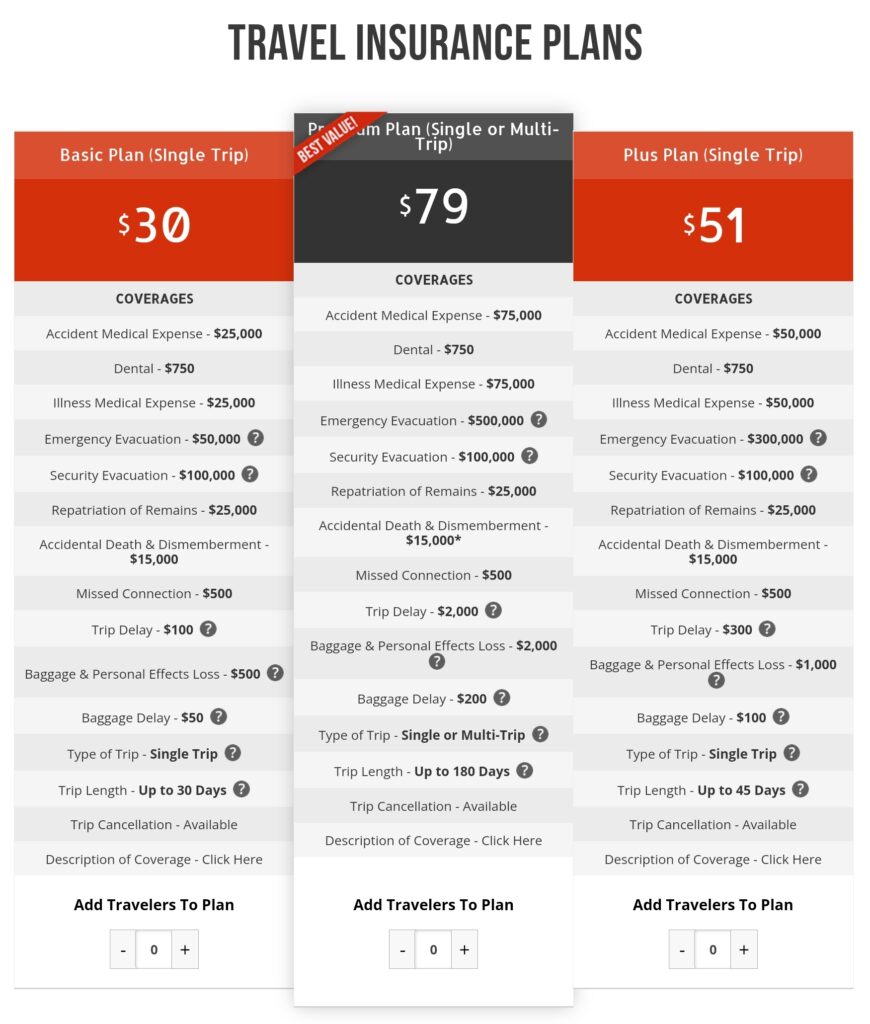

- Flexible Plans: Tailored plans that cater to different needs and budgets.

- Legal Coverage: In case of any legal problems, you have coverage for legal expenses.

- Dental Emergencies: Provides cover for unforeseen dental problems that might arise during your trip.

- Financial Protection: Safeguards against potential massive out-of-pocket expenses.

- Luggage Delay: Compensation if your luggage is delayed, helping you purchase essential items in the interim.

- Accidental Death & Dismemberment: Offers financial protection to your family in the case of a severe accident.

- Adventurous Activities Cover: Some policies cover activities which are often excluded from standard policies, essential for volunteers often working in varied terrains.

- Pre-existing Conditions: Some insurance plans might cover medical emergencies related to pre-existing conditions.

- Cultural & Language Barriers: Insurance providers often offer translation services, helping bridge communication gaps in foreign countries.

- Natural Disasters: Coverage in case of unexpected natural calamities.

- Political Unrest: Evacuation coverage if political situations make it unsafe for volunteers to stay.

- Extended Coverage: The option to extend coverage if you decide to stay longer or travel post your volunteering stint.

Why Opt for VolunteerCard with A Broader View?

- Specialized for Volunteers: Both VolunteerCard and A Broader View are platforms designed with the unique needs of volunteers in mind. While VolunteerCard offers tailored insurance options, A Broader View provides volunteer opportunities. Their collaboration ensures seamless integration of volunteering and insurance needs.

- Comprehensive Packages: VolunteerCard’s insurance packages are comprehensive, covering most risks associated with volunteering abroad.

- Reputable Partnership: A Broader View, a respected non-profit organization, recommends VolunteerCard, indicating trust and reliability.

- Discounted Rates: Through their partnership, volunteers might receive discounted rates on insurance, making it more affordable.

- Enhanced Support: Their combined services ensure that volunteers have support at every step of their journey – from selecting a project to ensuring safety during their stay.

In conclusion, when embarking on a journey to volunteer abroad, it’s essential to ensure your safety and peace of mind. Travel and health insurance provides a safety net against unforeseen circumstances, and opting for specialized services like VolunteerCard, especially in collaboration with A Broader View, further enhances the volunteer experience.

FAQs on Volunteering Abroad and Insurance:

- Why do I need travel and health insurance for volunteering abroad?

- Given the unforeseen challenges like health risks, political instability, or travel disruptions, insurance ensures your safety and financial protection.

- What is VolunteerCard?

- VolunteerCard is a specialized travel and health insurance platform tailored for the needs of volunteers traveling abroad.

- How is A Broader View associated with VolunteerCard?

- A Broader View is a respected non-profit offering volunteer opportunities, and they recommend VolunteerCard for comprehensive insurance coverage for their volunteers.

- Does travel insurance cover COVID-19 related issues?

- Policies vary, but many modern insurance plans now offer some form of coverage for COVID-19 related incidents. Check specific terms before purchasing.

- Are pre-existing conditions covered?

- Some insurance plans offer coverage for emergencies related to pre-existing conditions, but it’s essential to read the terms and conditions.

- What if I extend my volunteer program? Can I extend my insurance too?

- Yes, many insurance providers, including VolunteerCard, allow policy extensions to match your volunteering duration.

- Are natural calamities covered in travel insurance?

- Most comprehensive travel insurance plans cover unexpected natural disasters. However, specifics might vary by policy.

- Does travel insurance cover stolen belongings?

- Yes, many policies offer coverage for lost or stolen personal items. Ensure you understand the claim limits and required documentation.

- How do I claim insurance if needed while volunteering abroad?

- Insurance platforms usually provide 24/7 support. In the event of a claim, contact your provider immediately, and they’ll guide you through the process.

- Is it more expensive to get insurance tailored for volunteers?

- Not necessarily. Platforms like VolunteerCard offer competitive rates, and the specialized coverage ensures you’re not paying for unneeded extras.

Remember, each insurance policy and provider will have unique terms, so always read through the specifics and ask questions before finalizing your purchase.

-

Safe Solo Volunteering Abroad | Empowerment FemalesThrough Service with ABV

Embrace the adventure of a lifetime with ABV’s supported solo volunteering programs. Create lasting friendships, make a real difference, and explore the world safely under a supportive umbrella. Recommend Peru, Ecuador, Colombia, and more. Table of Contents Introduction to ABV and Solo Volunteering Traveling solo can be a thrilling yet daunting endeavor. A Broad View…

-

Empowerment Through Sustainable programs: Volunteer Opportunities in Peru Cusco

Discover empowering volunteer opportunities in Peru Cusco with www.abroaderview.org. Support sustainable programs and make a positive impact while gaining valuable experiences.

-

Midwives & Obstetricians: Empower Mothers & Babies Abroad

Discover how midwives and obstetricians from abroad can empower mothers and babies through the programs offered by www.abroaderview.org. Make a difference today.